In 2013, I was a freshman at Oklahoma State University, and in true freshman fashion I dropped all but 11 credit hours right at the drop date. Unfortunately for me, to keep my financial aid I had to maintain 12 credit hours, but where was I to find a class so late in the year? Luckily, OSU had a wonderful (and not passive aggressive at all) 1 credit hour class, that started in November, filled with people in the same situation as me! This class was a financial literacy class, all about spending money wisely, and how to get and maintain a good credit score. How useful!

As much fun as that class was, and it was; The point is, credit scores are so important to our day to day lives that OSU offered a class on them in the first place. Credit Scores are a rather old concept, originating around 5000 years ago (TIME). The version of the credit score that we know and use today was released in 1989, only 30 years ago. As time has gone on, credit scores have devolved into what they were created to overcome, and to understand how this has happened we need to look a bit into the history of credit scores.

Lenders in the past were not unbiased: did your banker like you, or your family, what church did you go to? These things were important; they of course had your credit history in front of them, but that was less important. “[These factors] often worked their way, consciously or not, into the banker’s judgment. And there’s a good chance he was more likely to trust people from his own circles. This was only human. But it meant that for millions of Americans the predigital status quo was just […] awful. Outsiders, including minorities and women, were routinely locked out. They had to put together an impressive financial portfolio—and then hunt for open-minded bankers” (Cathy O’Neil, Weapons of Math Destruction).

Well that is not Fair, is it?

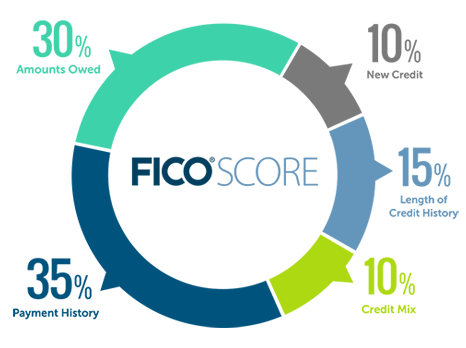

Well then along came Bill Fair, Earl Isaac, and Company (FICO), with a fancy new algorithm that was impartial (wow)! Your FICO score is a number between 300 and 850 determined by the following factors: payment history, amounts owed, length of credit history, types of credit used, and recent credit inquiries. “The score was color blind. And it turned out to be great for the banking industry, because it predicted risk far more accurately while opening the door to millions of new customers” (Cathy O’Neil)

And all bias in banking was ended forever. Good job lads! 👏

But that’s not true, is it? So Let’s break down the Modern Credit Scoring System™.

There are three important pieces to the modern credit score: FICO, FCRA, and the credit reporting companies.

- FICO

Fair, Issac and Company, “Founded in 1956, FICO introduced analytic solutions such as credit scoring that have made credit more widely available, not just in the United States but around the world. FICO’s groundbreaking use of Big Data and mathematical algorithms to predict consumer behavior has transformed entire industries. The company provides analytics software and tools used across multiple industries to manage risk, fight fraud, build more profitable customer relationships, optimize operations and meet strict government regulations.” (fico.com).

- FCRA

“In 1970—a landmark piece of legislation that required bureaus to open their files to the public; expunge data on race, sexuality and disability; and delete negative information after a specified period of time” (Time). The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. There are 12 main pillars of the FCRA, outlined here:

- You must be told if information in your file has been used against you.

- You have the right to know what is in your file.

- You have the right to ask for a credit score.

- You have the right to dispute incomplete or inaccurate information.

- Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information.

- Consumer reporting agencies may not report outdated negative information.

- Access to your file is limited.

- You must give your consent for reports to be provided to employers.

- You may limit “prescreened” offers of credit and insurance you get based on information in your credit report.

- You have a right to place a “security freeze” on your credit report, which will prohibit a consumer reporting agency from releasing information in your credit report without your express authorization.

- You may seek damages from violators.

- Identity theft victims and active duty military personnel have additional rights.

-Federal Trade Commission

- Consumer Reporting Agencies

Transunion, Experian, and Equifax. These are the 3 credit bureaus that you need to know and worry about, if someone pulls your credit score, it will come from one of these 3 companies. These companies use a version of the FICO score and must remain FCRA complaint. They compile information on a consumer to assess the risk involved in lending to them. “Credit bureaus get information from your creditors, such as a bank, credit card issuer, or auto finance company. They also get information about you from public records, such as property or court records. Each credit bureau gets its information from different sources, so the information in one credit bureau’s report may not be the same as the information in another credit bureau’s report” (Federal Reserve) Your name, address, full or partial Social Security number, date of birth, and possibly employment information. As well as your banking information, and public records.

These Credit Bureaus know a lot about you, and so many aspects of modern society are dependent on your good standing as told by these 3 companies. To get a loan for a house, or a car, to rent an apartment, apply for a credit card, or possibly even get a job; your credit needs to be good, or else you are out of luck.

We are using Big Data to compile financial profiles on people to ‘objectively’ determine whether or not they are a financial risk. These credit bureaus, as we have discussed, have done this by using advanced algorithms that use the stockpiled information to assign a numerical measure of risk. This of course requires the very important and private information of millions of individuals. When it comes to our data, privacy should be key, especially when it comes to such sensitive information.

Sadly this is not always the case. In September 2017, “Equifax disclosed that hackers stole the personal information of 147.7 million Americans from its servers. It was a Thursday afternoon when Equifax explained that hackers infiltrated its network and stole customer names, Social Security numbers, birthdates and addresses, affecting more than half the US population” (cNET). Ya know just life-ending stuff, no biggie.

Despite the Equifax breach deemed not a FCRA violation in court (National Law Review). It does bring up a good question about data accountability under the law. Since this breach, Equifax has had few repercussions from the government. So what can consumers even do to keep their information safe? Luckily the FCRA exists, allowing consumers to place a security freeze on their accounts (after the fact), but if FCRA was non-existent or not applicable to the field, what could consumers do to protect their data?

The existence of FCRA in the credit-reporting world is what sets credit-reporting apart from other types of data collection entities. “As it stands, privacy as a concept isn’t about shutting off from the world or hiding our vulnerabilities from some empowered surveillant eye” (We Are Data). Part of privacy is control, transparency, and accountability. If I give you my information, I want to know what you are doing with it, and if it leaves your hands without my consent I would like you to be accountable for that. While FCRA is not perfect, it does provide a layer of transparency and accountability from the collector to the consumer, guidelines that are not present for other types of data brokers (Black Box Society).

As data collection becomes more and more prevalent in our society, we are also seeing the rise of e-scores. E-scores “can take into account facts like occupation, salary and home value, to spending on luxury goods or pet food, and do it all with algorithms that their creators say accurately predict spending” and most importantly, these scores are kept secret from the public (NYT). “Federal regulators and consumer advocates worry that these scores could eventually put some consumers at a disadvantage, particularly those under financial stress” (NYT). Scores like these are being used in conjunction with a typical credit report, adding an extra layer of bias to the mix, if you are deemed high-risk, you may not get a loan even if your credit-score is good, your e-score may not be. And with an e-score, you have no rights under the FCRA. “The right to correct and inspect data should be extended to the companies proper” (Black Box Society).

The idea of credit reports is a good one, you access a person’s risk based on past activity: loan repayment, amount of accrued debt, number of loans, and so on. All hard data, based on an individual’s activity separate from demographic information. The original concept of credit reports reduced risk for lenders, and increased chances of getting a loan for people in discriminated groups. The idea behind these reports was to remove bias, or at least help remove bias. Big Data can do a lot of cool things, and it can help a lot of people, but it can also be incredibly harmful. With the rise of data-collection agencies and subsequently e-scores, the collection of personal data begins grouping people based on demographic and group activity. So if you belong to a group deemed ‘high-risk’, even if your personal credit history is excellent you are automatically deemed as ‘riskier’ than other people. This kind of system feeds into systemic racism and perpetuates a system that keeps poor people poor, and rich people rich.

http://time.com/3961676/history-credit-scores/

https://www.consumer.ftc.gov/articles/pdf-0096-fair-credit-reporting-act.pdf

https://www.federalreserve.gov/creditreports/pdf/credit_reports_scores_2.pdf

https://www.nytimes.com/2012/08/19/business/electronic-scores-rank-consumers-by-potential-value.html

https://www.natlawreview.com/article/equifax-dodges-fcra-claims-2017-data-breach

fico.com/en/about-us#our-company

Weapons of Math Destruction: How Big Data Increases Inequality and Threatens Democracy – Cathy O’Neil

The Black Box Society

We Are Data